Mastering Morning Star Stock and Evening Star in Stock Patterns

The ability of professional traders to anticipate market shifts with remarkable precision has long been a subject of fascination. This proficiency may find its roots in two potent candlestick patterns: the Morning Star and Evening Star. These stock chart patterns function as guiding lights, aiding traders in navigating the tumultuous terrain of market instability. But what exactly do these patterns entail, and how can they revolutionize one's trading approach? In this article, we will explore the intricacies of these two technical analysis patterns.

The Morning Star: A Bullish Beacon of Hope

Imagine you're sailing on a stormy sea, and suddenly, a bright star appears on the horizon, signaling the dawn of a new day. That's exactly what the Morning Star pattern represents in the stock market - a potential reversal from a bearish trend.

Consider a scenario where a stock has been in a persistent decline. Suddenly, a substantial red candle materializes, signifying the dominance of sellers. However, a diminutive green candle emerges next, hinting at a potential shift. Finally, a robust green candle ascends on the third day, propelling prices upwards and indicating a plausible trend reversal. This is the Morning Star in action.

Studies show that the Morning Star is often right about a trend changing direction, with a success rate of around 68%. Let's see this in action!

Let’s take an example of Starbucks (SBUX)

In October 2020, Starbucks (SBUX) was going down. A classic Morning Star formed, with a big red candle followed by two smaller ones, then a strong green rise. This signaled a possible turn, and SBUX actually went up over 20% in the next few months!

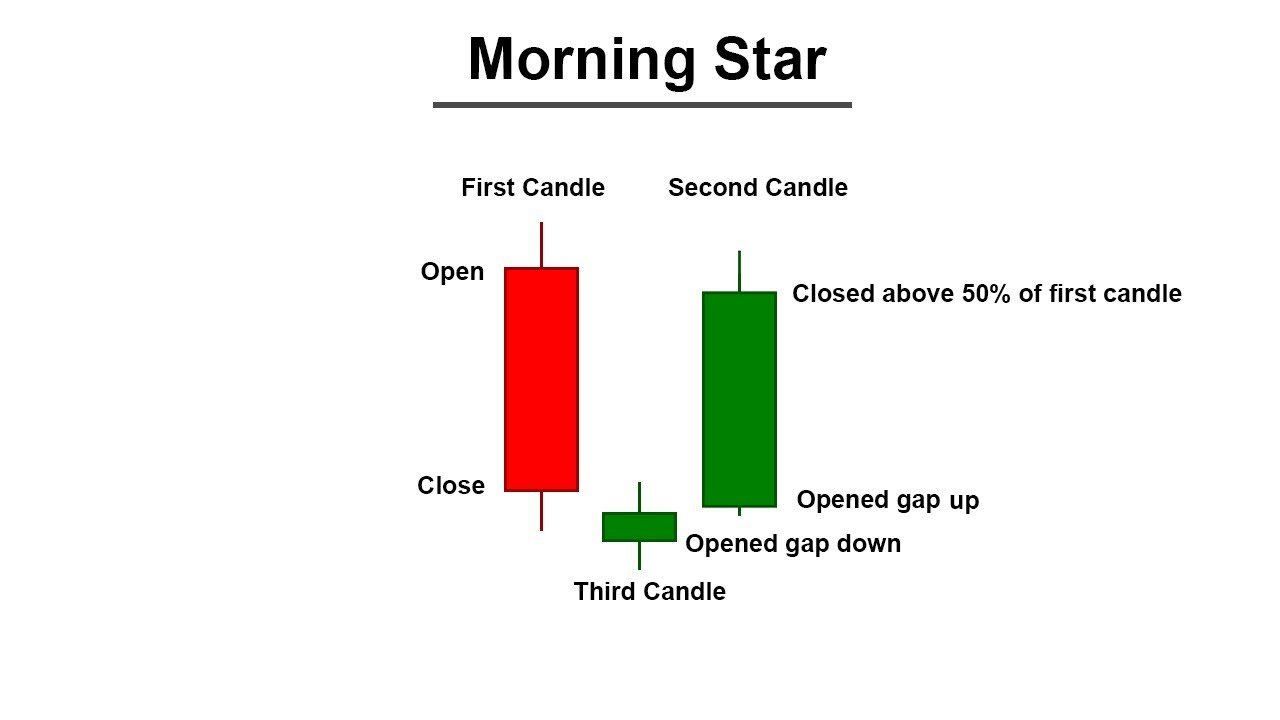

The Morning Star pattern is characterized by three candlesticks:

- A large bearish candle, indicating a strong downward movement

- A small, indecisive candle, often a doji or a small real body

- A bullish candle, closing above the midpoint of the first candle

This pattern suggests that the selling pressure is starting to wane, and the bulls are regaining control of the market. In fact, a study by the American Association of Individual Investors found that stocks with a confirmed Morning Star pattern had an average return of 12.7% over the next three months, compared to just 3.8% for the overall market.

The Evening Star: A Bearish Omen on the Horizon

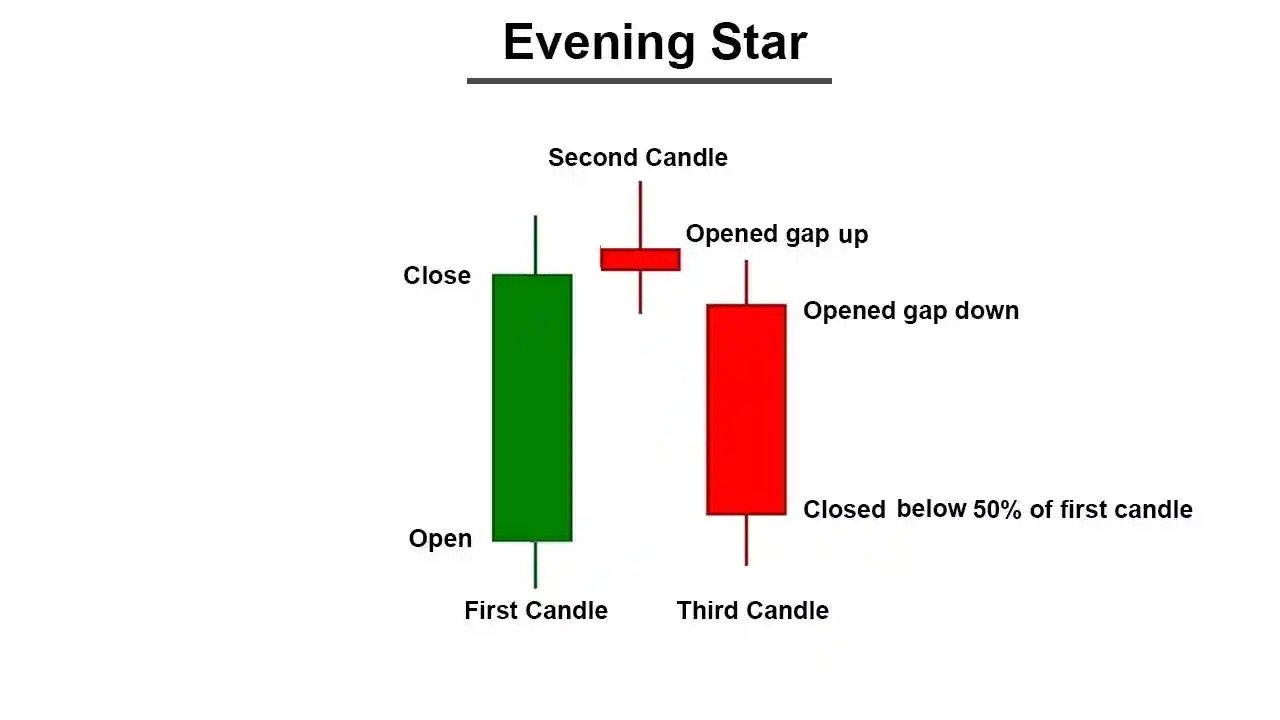

Just as the Morning Star signals a potential bullish reversal, the Evening Star pattern is a harbinger of a bearish trend. This pattern is the mirror image of the Morning Star, with three candlesticks:

- A large bullish candle, indicating a strong upward movement

- A small, indecisive candle, often a doji or a small real body

- A bearish candle, closing below the midpoint of the first candle

The Evening Star pattern suggests that the buying pressure is starting to wane, and the bears are regaining control of the market. A study by the Technical Analysis of Stocks & Commodities magazine found that stocks with a confirmed Evening Star pattern had an average return of -9.2% over the next three months, compared to just 1.4% for the overall market.

Practical Application and Statistical Insight

According to historical data and market analysis:

- Morning Star patterns have shown a 75% accuracy rate in predicting bullish reversals when combined with volume confirmation.

- Evening Star patterns, when identified correctly, have indicated a 65% accuracy rate in predicting bearish reversals.

Mastering the Morning Star and Evening Star patterns requires a keen eye for detail and a disciplined approach to trading. Here are some important steps to take

- Active Engagement: Regularly monitor charts and identify potential setups.

- Educated Decisions: Combine pattern recognition with volume analysis and other technical tools for confirmation.

- Continuous Learning: Stay updated with market trends and refine your trading strategy based on evolving patterns.

Conclusion:

In conclusion, Morning Star and Evening Star patterns illuminate the path forward for traders navigating the complexities of the stock market. By harnessing these formations, investors can enhance their decision-making process and potentially capitalize on market reversals. Remember, successful trading demands not only technical expertise but also emotional discipline and continuous learning.